Appendix B: Statistics

The material in this appendix can be supplemented with the classic text in

statistics: The Theory of Point Estimation Wiley, New

York by E. Lehmann (1983).

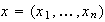

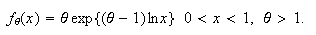

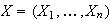

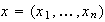

Sufficiency, Completeness and Unbiased Estimation

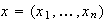

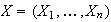

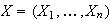

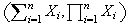

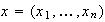

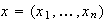

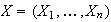

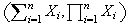

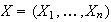

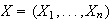

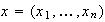

In statistics, we often represent our data, in many cases a sample of size

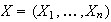

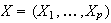

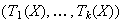

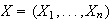

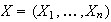

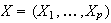

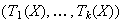

from some population as a random vector

from some population as a random vector

.

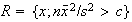

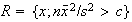

The model, can be written in the form

.

The model, can be written in the form

where

where

is the parameter space or set of permissible values of the parameter

and

is the parameter space or set of permissible values of the parameter

and

is the probability density function. A statistic,

is the probability density function. A statistic,

is a function of the data which does not depend on the unknown parameter

is a function of the data which does not depend on the unknown parameter

.

Although a statistic,

.

Although a statistic,

is not a function of

is not a function of

,

its distribution can depend on

,

its distribution can depend on

An estimator is a statistic considered for the purpose of estimating a given

parameter. One of our objectives is to find a ``good'' estimator of

the parameter

An estimator is a statistic considered for the purpose of estimating a given

parameter. One of our objectives is to find a ``good'' estimator of

the parameter

,

in some sense of the word ``good''. How do we ensure that a statistic

,

in some sense of the word ``good''. How do we ensure that a statistic

is estimating the correct parameter and not consistently too large or too

small, and that as much variability as possible has been removed? The problem

of estimating the correct parameter is often dealt with by requiring that the

estimator be unbiased.

is estimating the correct parameter and not consistently too large or too

small, and that as much variability as possible has been removed? The problem

of estimating the correct parameter is often dealt with by requiring that the

estimator be unbiased.

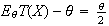

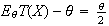

We will denote an expected value under the assumed parameter value

by

by

.

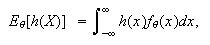

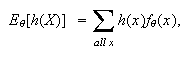

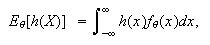

Thus, in the continuous case

.

Thus, in the continuous case

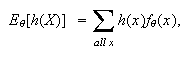

and in the discrete case

and in the discrete case

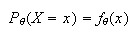

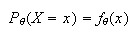

provided the integral/sum converges absolutely. In the discrete case,

provided the integral/sum converges absolutely. In the discrete case,

the probability function of

the probability function of

under this parameter value

under this parameter value

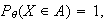

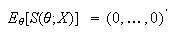

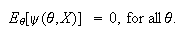

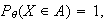

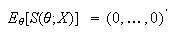

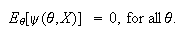

Definition

A statistic

is an unbiased estimator of

is an unbiased estimator of

if

if

for all

for all

.

.

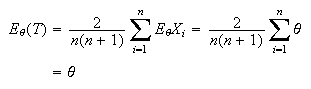

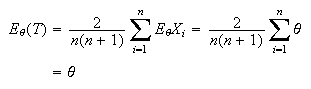

For example suppose that

are independent, each with the Poisson distribution with parameter

are independent, each with the Poisson distribution with parameter

.

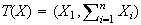

Notice that the statistic

.

Notice that the statistic

is such

that

is such

that and so

and so

is an unbiased estimator of

is an unbiased estimator of

This means that it is centered in the correct place, but does not mean it is a

best estimator in any sense.

This means that it is centered in the correct place, but does not mean it is a

best estimator in any sense.

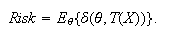

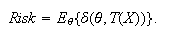

In Decision Theory, in order to determine whether a given estimator

or statistic

does well for estimating

does well for estimating

we consider a loss function or distance function between the estimator and the

true value. Call this

we consider a loss function or distance function between the estimator and the

true value. Call this

.

Then this is averaged over all possible values of the data to obtain the risk:

.

Then this is averaged over all possible values of the data to obtain the risk:

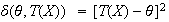

A good estimator is one with little risk, a bad estimator is one whose risk is

high. One particular risk function is called mean squared error

(M.S.E.) and corresponds to

A good estimator is one with little risk, a bad estimator is one whose risk is

high. One particular risk function is called mean squared error

(M.S.E.) and corresponds to

.

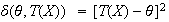

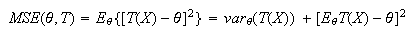

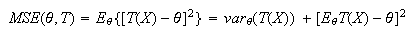

The mean squared error has a useful decomposition into two components the

variance of the estimator and the square of its bias:

.

The mean squared error has a useful decomposition into two components the

variance of the estimator and the square of its bias:

For example, if

has a

Normal

has a

Normal distribution, the mean squared error of

distribution, the mean squared error of

is 1 for all

is 1 for all

because the bias

because the bias

is zero. On the other hand the estimator

is zero. On the other hand the estimator

has bias

has bias

and variance

and variance

so the mean squared error is

so the mean squared error is

Obviously

Obviously

has smaller mean squared error provided that

has smaller mean squared error provided that

is

around 0 (more precisely provided

is

around 0 (more precisely provided

,

but for

,

but for

large,

large,

is preferable. Of these two estimators, only

is preferable. Of these two estimators, only

is unbiased.

is unbiased.

In general, in fact, there is usually no one estimator which outperforms all

other estimators at all values of the parameter if we use mean squared error

as our basis for comparison. In order to achieve an

optimal estimator, it is unfortunately necessary to restrict

ourselves to a specific class of estimators and select the best within the

class. Of course, the best within this class will only be as good as the class

itself (best in a class of one is not much of a recommendation), and therefore

we must ensure that restricting ourselves to this class is not unduly

restrictive. The class of all estimators is usually too large to

obtain a meaningful solution. One common restriction is to the class of all

unbiased estimators.

Definition

An estimator

is said to be a uniformly minimum variance unbiased estimator

(U.M.V.U.E.) of the parameter

is said to be a uniformly minimum variance unbiased estimator

(U.M.V.U.E.) of the parameter

if

if

(i) it is an unbiased estimator of

and

and

(ii) among all unbiased estimators of

it has the smallest mean squared error and therefore the smallest variance.

it has the smallest mean squared error and therefore the smallest variance.

A sufficient statistic is one that, from a certain perspective,

contains all the necessary information for making inferences (e.g. estimating

the parameter with a point estimator or confidence interval, conducting a test

of a hypothesized value) about the unknown parameters in a given model. It is

important to remember that a statistic is sufficient for inference on a

specific parameter. It does not necessary contain all relevant information in

the data for other inferences. For example if you wished to test whether the

family of distributions is an adequate fit to the data ( a goodness of fit

test) the sufficient statistic for the parameter in the model does not contain

the relevant information.

Suppose the data is in a vector

and

and

is a sufficient statistic for

is a sufficient statistic for

.

The intuitive basis for sufficiency is that if the conditional distribution of

.

The intuitive basis for sufficiency is that if the conditional distribution of

given

given

does not depend on

does not depend on

,

then

,

then

provides no additional value in addition to

provides no additional value in addition to

for estimating

for estimating

.

The assumption is that random variables carry information on a statistical

parameter

.

The assumption is that random variables carry information on a statistical

parameter

only insofar as their distributions (or conditional distributions) change with

the value of the parameter and that since, given

only insofar as their distributions (or conditional distributions) change with

the value of the parameter and that since, given

we can randomly generate at random values for the

we can randomly generate at random values for the

without knowledge of the parameter and with the correct distribution, these

randomly generated values cannot carry additional information. All of this, of

course, assumes that the model is correct and

without knowledge of the parameter and with the correct distribution, these

randomly generated values cannot carry additional information. All of this, of

course, assumes that the model is correct and

is the only unknown. The distribution of

is the only unknown. The distribution of

given a sufficient statistic

given a sufficient statistic

will often have value for other purposes, such as measuring the variability of

the estimator or testing the validity of the model.

will often have value for other purposes, such as measuring the variability of

the estimator or testing the validity of the model.

Definition

A statistic

is sufficient for a statistical model

is sufficient for a statistical model

if the distribution of the data

if the distribution of the data

given

given

does not depend on the unknown parameter

does not depend on the unknown parameter

.

.

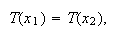

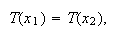

The use of a sufficient statistic is formalized in the The

Sufficiency Principle, which states that if

is a sufficient statistic for a model

is a sufficient statistic for a model

and

and

are two different possible observations that have identical values of the

sufficient statistic:

are two different possible observations that have identical values of the

sufficient statistic:

then whatever inference we would draw from observing

then whatever inference we would draw from observing

we should draw exactly the same inference from

we should draw exactly the same inference from

.

.

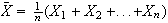

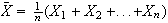

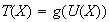

Sufficient statistics are not unique. For example if the

sample mean

is a sufficient statistic, then any other statistic, that allows us to obtain

is a sufficient statistic, then any other statistic, that allows us to obtain

is also sufficient. This will include all one-to-one functions of

is also sufficient. This will include all one-to-one functions of

(these are essentially equivalent) like

(these are essentially equivalent) like

and all statistics

and all statistics

for which we can write

for which we can write

for some, possibly many-to-one function

for some, possibly many-to-one function

.

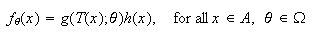

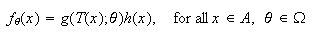

One result which is normally used to verify whether a given statistic is

sufficient is the Factorization Criterion for Sufficiency:

Suppose

.

One result which is normally used to verify whether a given statistic is

sufficient is the Factorization Criterion for Sufficiency:

Suppose

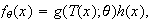

has probability density function

has probability density function

and

and

is a statistic. Then

is a statistic. Then

is a sufficient statistic for

is a sufficient statistic for

if and only if there exist two non--negative functions

if and only if there exist two non--negative functions

and

and

so that we can factor the probability density function

so that we can factor the probability density function

for all

for all

This factorization into two pieces, one which involves both the statistic

This factorization into two pieces, one which involves both the statistic

and the unknown parameter

and the unknown parameter

and the other which may be a constant or depend on

and the other which may be a constant or depend on

but does not depend on the unknown parameter, need only hold on a set

but does not depend on the unknown parameter, need only hold on a set

of possible values of

of possible values of

which carries the full probability. That is for some set

which carries the full probability. That is for some set

with

with

for all

for all

,

we require

,

we require

Definition

A statistic

is a minimal sufficient statistic for

is a minimal sufficient statistic for

if it is sufficient and if for any other sufficient statistic

if it is sufficient and if for any other sufficient statistic

,

there exists a function

,

there exists a function

such that

such that

.

.

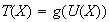

This definition says in effect that a minimal sufficient statistic can be

recovered from any other sufficient statistic. A statistic

implicitly partitions the sample space into events of the form

implicitly partitions the sample space into events of the form

![$[T(X)=x]$](graphics/appendixb__114.png) for varying

for varying

and if

and if

is minimal sufficient, it induces the coarsest possible partition (i.e. the

largest possible sets) in the sample space among all sufficient statistics.

This partition is called the minimal sufficient partition.

is minimal sufficient, it induces the coarsest possible partition (i.e. the

largest possible sets) in the sample space among all sufficient statistics.

This partition is called the minimal sufficient partition.

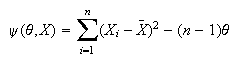

The property of completeness is one which is useful for determining

the uniqueness of estimators and verifying in some cases that a minimal

sufficient reduction has been found. It bears no relation to the notion of a

complete market in Finance, or the mathematical notion of a complete metric

space. Let

denote the observations from a distribution with probability density function

denote the observations from a distribution with probability density function

.

Suppose

.

Suppose

is a statistic and

is a statistic and

,

a function of

,

a function of

,

is an unbiased estimator of

,

is an unbiased estimator of

so that

so that

.

Under what circumstances is this the only unbiased estimator which is a

function of

.

Under what circumstances is this the only unbiased estimator which is a

function of

?

To answer this question, suppose

?

To answer this question, suppose

and

and

are both unbiased estimators of

are both unbiased estimators of

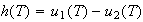

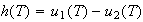

and consider the difference

and consider the difference

.

Since

.

Since

and

and

are both unbiased estimators of the parameter

are both unbiased estimators of the parameter

we have

we have

![$E_{\theta}[h(T)]=0$](graphics/appendixb__135.png) for all

for all

.

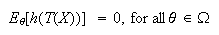

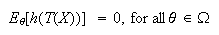

Now if the only function

.

Now if the only function

which satisfies

which satisfies

![$E_{\theta}[h(T)]=0$](graphics/appendixb__138.png) for all

for all

is the zero function

is the zero function

,

then the two unbiased estimators must be identical. A statistic

,

then the two unbiased estimators must be identical. A statistic

with this property is said to be complete. Technically it is not the

statistic that is complete, but the family of distributions of

with this property is said to be complete. Technically it is not the

statistic that is complete, but the family of distributions of

in the model

in the model

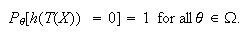

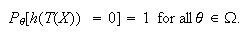

Definition

The statistic

is complete if

is complete if

for any function

for any function

implies

implies

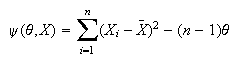

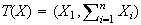

For example, let

be a random sample from the

Normal

be a random sample from the

Normal distribution. Consider

distribution. Consider

.

Then

.

Then

is sufficient for

is sufficient for

but is not complete. It is easy to see that it is not complete, because the

function

but is not complete. It is easy to see that it is not complete, because the

function

is a function of

is a function of

which has zero expectation for all values of

which has zero expectation for all values of

and yet the function is not identically zero. The fact that the statistic

and yet the function is not identically zero. The fact that the statistic

is sufficient but not complete is a hint that further reduction is possible,

that it is not minimal sufficient. In fact in this case, as we will show a

little later, taking only the second component of

is sufficient but not complete is a hint that further reduction is possible,

that it is not minimal sufficient. In fact in this case, as we will show a

little later, taking only the second component of

namely

namely

provides a minimal sufficient, complete statistic.

provides a minimal sufficient, complete statistic.

Theorem B1

If

is a complete and sufficient statistic for the model

is a complete and sufficient statistic for the model

,

then

,

then

is a minimal sufficient statistic for the model.

is a minimal sufficient statistic for the model.

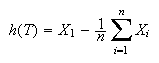

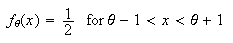

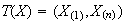

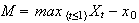

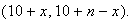

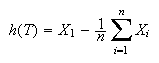

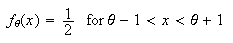

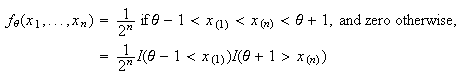

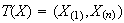

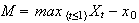

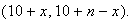

The converse to the above theorem is not true. Let

be a random sample from the continuous uniform distribution on the interval

be a random sample from the continuous uniform distribution on the interval

.

This distribution has probability density function

.

This distribution has probability density function

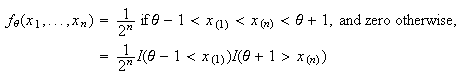

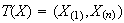

Then using the factorization criterion above, the joint probability density

function for a sample of

Then using the factorization criterion above, the joint probability density

function for a sample of

independent observations from this density is

independent observations from this density is

where

where

is one or zero as the inequality holds or does not hold and

is one or zero as the inequality holds or does not hold and

are the smallest and the largest values in the sample

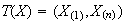

are the smallest and the largest values in the sample

Obviously

Obviously

can be written as a function

can be written as a function

where

where

and so

and so

is sufficient. Moreover it is not difficult to show that no further reduction

(for example to

is sufficient. Moreover it is not difficult to show that no further reduction

(for example to

alone) is possible or we can not longer provide such a factorization, so

alone) is possible or we can not longer provide such a factorization, so

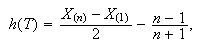

us minimal sufficient. Nevertheless, if

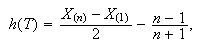

us minimal sufficient. Nevertheless, if

and the function

and the function

is defined by

is defined by

(clearly a non-zero function) then

(clearly a non-zero function) then

![$E_{\theta}[h(T)]=0$](graphics/appendixb__179.png) for all

for all

and therefore

and therefore

is not a complete statistic.

is not a complete statistic.

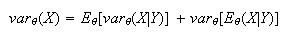

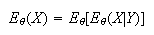

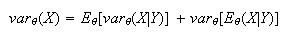

Theorem B2

For any random variables

and

and

,

,

and

and

In much of what follows, we wish to be able to estimate a general

function of the unknown parameter like

instead of the parameter

instead of the parameter

itself. We have already seen that if

itself. We have already seen that if

is a complete statistic, then there is at most one function of

is a complete statistic, then there is at most one function of

that provides an unbiased estimator of any function of a given

that provides an unbiased estimator of any function of a given

In fact if we can find such a function,

In fact if we can find such a function,

then it automatically has minimum variance among all possible unbiased

estimators of

then it automatically has minimum variance among all possible unbiased

estimators of

that are based on the same data.

that are based on the same data.

Theorem B3

If

is a complete sufficient statistic for the model

is a complete sufficient statistic for the model

and

and

,

then

,

then

is the U.M.V.U.E. of

is the U.M.V.U.E. of

.

.

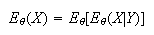

When we have a complete sufficient statistic, and we are able to find an

unbiased estimator, even a bad one, of

then there is a simple recipe for determining the U.M.V.U.E. of

then there is a simple recipe for determining the U.M.V.U.E. of

Theorem B4

If

is a complete sufficient statistic for the model

is a complete sufficient statistic for the model

and

and

is any unbiased estimator of

is any unbiased estimator of

,

then

,

then

is the U.M.V.U.E. of

is the U.M.V.U.E. of

.

.

Note that we did not subscript the conditional expectation

with

with

because whenever

because whenever

is a sufficient statistic, the conditional distribution of

is a sufficient statistic, the conditional distribution of

given

given

does not depend on the underlying value of the parameter

does not depend on the underlying value of the parameter

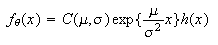

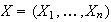

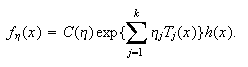

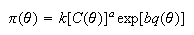

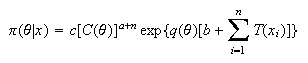

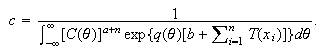

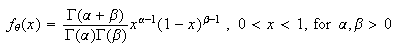

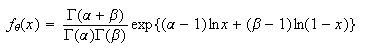

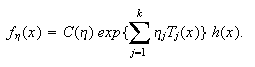

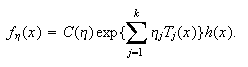

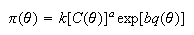

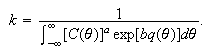

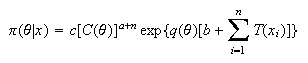

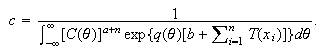

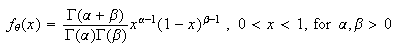

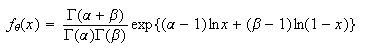

Definition

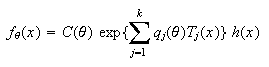

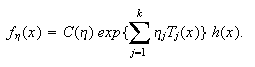

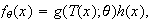

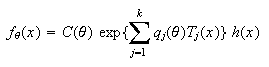

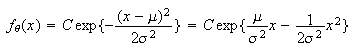

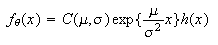

Suppose

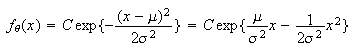

has a (joint) probability density function of the form

has a (joint) probability density function of the form

for functions

for functions

.

Then we say that the density is a member of the exponential family of

densities. We call

.

Then we say that the density is a member of the exponential family of

densities. We call

the natural sufficient statistic.

the natural sufficient statistic.

A member of the exponential family could be re-expressed in different ways and

so the natural sufficient statistic is not unique. For example we may multiply

a given

by a constant and divide the corresponding

by a constant and divide the corresponding

by the same constant, resulting in the same probability density function

by the same constant, resulting in the same probability density function

.

Various other conditions need to be applied as well, for example to insure

that the

.

Various other conditions need to be applied as well, for example to insure

that the

are all essentially different functions of the data. One of the important

properties of the exponential family is its closure under repeated independent

sampling. In general if

are all essentially different functions of the data. One of the important

properties of the exponential family is its closure under repeated independent

sampling. In general if

are independent identically distributed with an exponential family

distribution then their joint distribution

are independent identically distributed with an exponential family

distribution then their joint distribution

is also an exponential family distribution.

is also an exponential family distribution.

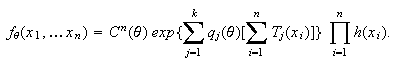

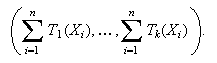

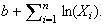

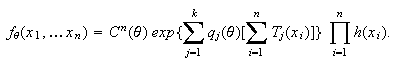

Theorem B5

Let

( be a random sample from the distribution with probability density function

given by (exfd). Then

be a random sample from the distribution with probability density function

given by (exfd). Then

also has an exponential family form, with joint probability density function

also has an exponential family form, with joint probability density function

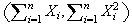

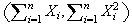

In other words,

is replaced by

is replaced by

and

and

by

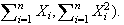

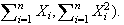

by

.

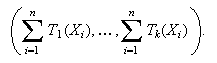

The natural sufficient statistic is

.

The natural sufficient statistic is

It is usual to reparameterize equation

(exfd) by replacing

by a new parameter

by a new parameter

.

This results in a more efficient representation, the canonical form

of the exponential family density:

.

This results in a more efficient representation, the canonical form

of the exponential family density:

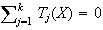

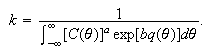

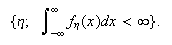

The natural parameter space in this form is the set of all values of

The natural parameter space in this form is the set of all values of

for which the above function is integrable; that is

for which the above function is integrable; that is

We would like this parameter space to be large enough to allow intervals for

each of the components of the vector

We would like this parameter space to be large enough to allow intervals for

each of the components of the vector

and so we will later need to assume that the natural parameter space contains

a

and so we will later need to assume that the natural parameter space contains

a

dimensional

rectangle.

dimensional

rectangle.

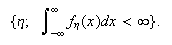

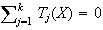

If the statistic satisfies a linear constraint, for example,

with probability one, then the number of terms

with probability one, then the number of terms

could be reduced and a more efficient representation of the probability

density function is possible. Similarly if the parameters

could be reduced and a more efficient representation of the probability

density function is possible. Similarly if the parameters

satisfy a linear relationship, they are not all statistically meaningful

because one of the parameters is obtainable from the others. These are all

situations that we would handle by reducing the model to a more efficient and

non-redundant form. So in the remaining, we will generally assume such a

reduction has already been made and that the exponential family representation

is minimal in the sense that neither the

satisfy a linear relationship, they are not all statistically meaningful

because one of the parameters is obtainable from the others. These are all

situations that we would handle by reducing the model to a more efficient and

non-redundant form. So in the remaining, we will generally assume such a

reduction has already been made and that the exponential family representation

is minimal in the sense that neither the

nor the

nor the

satisfy any linear constraints.

satisfy any linear constraints.

Definition

We will say that

has a regular exponential family distribution if it is in canonical

form, is of full rank in the sense that neither the

has a regular exponential family distribution if it is in canonical

form, is of full rank in the sense that neither the

nor the

nor the

satisfy any linear constraints permitting a reduction in the value of

satisfy any linear constraints permitting a reduction in the value of

,

and the natural parameter space contains a

,

and the natural parameter space contains a

dimensional

rectangle.

dimensional

rectangle.

By Theorem B5, if

has a regular exponential family distribution then

has a regular exponential family distribution then

also has a regular exponential family distribution.

also has a regular exponential family distribution.

The main advantage identifying a distribution as a member of the regular

exponential family is that it allows to to quickly identify the minimal

sufficient statistic and conclude that it is complete.

Theorem B6

If

has a regular exponential family distribution then

has a regular exponential family distribution then

is a complete sufficient statistic.

is a complete sufficient statistic.

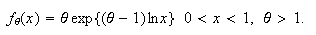

Example

Let

be independent observations all from the normal

be independent observations all from the normal

distribution. Notice that with the parameter

distribution. Notice that with the parameter

we can write the probability density function of each

we can write the probability density function of each

as a constant

as a constant

so the natural parameters are

so the natural parameters are

and

and

and the natural sufficient statistic is

(

and the natural sufficient statistic is

( For a sample of size

For a sample of size

from this density we have the same natural parameters, and, by the above

theorem, a complete sufficient statistic is

(

from this density we have the same natural parameters, and, by the above

theorem, a complete sufficient statistic is

( For example if you wished to find a U.M.V.U.E. of any function of

For example if you wished to find a U.M.V.U.E. of any function of

, for example the parameter

, for example the parameter

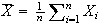

we need only find some function of the compete sufficient statistic which has

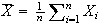

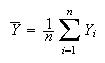

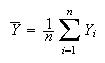

the correct expected value. For example, in this case, with the sample mean

we need only find some function of the compete sufficient statistic which has

the correct expected value. For example, in this case, with the sample mean

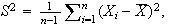

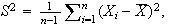

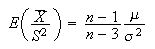

and the sample variance

and the sample variance

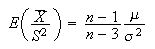

it is not difficult to show that

it is not difficult to show that

and so, provided

and so, provided

is an unbiased estimator and a function of the complete sufficient statistic

so it is the desired U.M.V.U.E. Suppose one of the parameters, say

is an unbiased estimator and a function of the complete sufficient statistic

so it is the desired U.M.V.U.E. Suppose one of the parameters, say

is assumed known. Then the normal distribution is still in the regular

exponential family, since it has a representation

is assumed known. Then the normal distribution is still in the regular

exponential family, since it has a representation

with the function

with the function

completely known. In this case, for a sample of size

completely known. In this case, for a sample of size

from this distribution, the statistic

from this distribution, the statistic

is complete sufficient for

is complete sufficient for

and so any function of it, say

and so any function of it, say

which is an unbiased estimator of

which is an unbiased estimator of

is automatically U.M.V.U.E.

is automatically U.M.V.U.E.

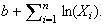

The Table below gives various members of the regular exponential family and

the corresponding complete sufficient statistic.

| Members of the Regular Exponential Family |

|

Complete Sufficient Statistic |

|

|

|

|

|

|

Binomial

Binomial

|

|

|

Geometric( |

|

|

|

if

known

known |

|

|

known

known |

|

|

|

|

(includes exponential)

(includes exponential) |

if

known

known |

|

|

if

known

known |

|

|

|

|

Differentiating under the Integral

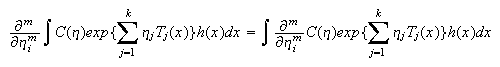

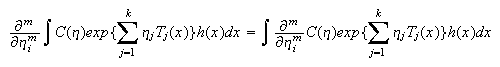

For a regular exponential family, it is possible to differentiate under the

integral, that is,

for any

for any

and any

and any

in the interior of the natural parameter space.

in the interior of the natural parameter space.

Let

denote observations from a distribution with probability density function

denote observations from a distribution with probability density function

and let

and let

be a statistic. The information on the parameter

be a statistic. The information on the parameter

is provided by the sensitivity of the distribution of a statistic to changes

in the parameter. For example, suppose a modest change in the parameter value

leads to a large change in the expected value of the distribution resulting in

a large shift in the data. Then the parameter can be estimated fairly

precisely. On the other hand, if a statistic

is provided by the sensitivity of the distribution of a statistic to changes

in the parameter. For example, suppose a modest change in the parameter value

leads to a large change in the expected value of the distribution resulting in

a large shift in the data. Then the parameter can be estimated fairly

precisely. On the other hand, if a statistic

has no sensitivity at all in distribution to the parameter, then it would

appear to contain little information for point estimation of this parameter. A

statistic of the second kind is called an ancillary statistic.

has no sensitivity at all in distribution to the parameter, then it would

appear to contain little information for point estimation of this parameter. A

statistic of the second kind is called an ancillary statistic.

Definition

is an ancillary statistic if its distribution does not depend on the

unknown parameter

is an ancillary statistic if its distribution does not depend on the

unknown parameter

.

.

Ancillary statistics are, in a sense, orthogonal or perpendicular to minimal

sufficient statistics and are analogous to the residuals in a multiple

regression, while the complete sufficient statistics are analogous to the

estimators of the regression coefficients. It is well-known that the residuals

are uncorrelated with the estimators of the regression coefficients (and

independent in the case of normal errors). However, the ``irrelevance'' of the

ancillary statistic seems to be limited to the case when it is not part of the

minimal (preferably complete) sufficient statistic as the following example

illustrates.

Example

Suppose a fair coin is tossed to determine a random variable

with probability

with probability

and

and

otherwise. We then observe a Binomial random variable

otherwise. We then observe a Binomial random variable

with parameters

with parameters

.

Then the minimal sufficient statistic is

.

Then the minimal sufficient statistic is

but

but

is an ancillary statistic since its distribution does not depend on the

unknown parameter

is an ancillary statistic since its distribution does not depend on the

unknown parameter

.

Is

.

Is

completely irrelevant to inference about

completely irrelevant to inference about

?

If you reported to your boss an estimator of

?

If you reported to your boss an estimator of

such as

such as

without telling him or her the value of

without telling him or her the value of

how long would you expect to keep your job? Clearly any sensible inference

about

how long would you expect to keep your job? Clearly any sensible inference

about

should include information about the precision of the estimator, and this

inevitably requires knowing the value of

should include information about the precision of the estimator, and this

inevitably requires knowing the value of

Although the distribution of

Although the distribution of

does not depend on the unknown parameter

does not depend on the unknown parameter

so that

so that

is ancillary, it carries important information about precision. The following

theorem allows us to use the properties of completeness and ancillarity to

prove the independence of two statistics without finding their joint

distribution.

is ancillary, it carries important information about precision. The following

theorem allows us to use the properties of completeness and ancillarity to

prove the independence of two statistics without finding their joint

distribution.

Basu's Theorem B7

Consider

with probability density function

with probability density function

.

Let

.

Let

be a complete sufficient statistic. Then

be a complete sufficient statistic. Then

is independent of every ancillary statistic

is independent of every ancillary statistic

.

.

Example

Assume

represents the market price of a given asset such as a portfolio of stocks at

time

represents the market price of a given asset such as a portfolio of stocks at

time

and

and

is the value of the portfolio at the beginning of a given time period (assume

that the analysis is conditional on

is the value of the portfolio at the beginning of a given time period (assume

that the analysis is conditional on

so that

so that

is fixed and known). The process

is fixed and known). The process

is assumed to be a Brownian motion and so the distribution of

is assumed to be a Brownian motion and so the distribution of

for any fixed time

for any fixed time

is

Normal

is

Normal for

for

.

Suppose that for a period of length 1, we record both the period high

.

Suppose that for a period of length 1, we record both the period high

and the close

and the close

.

Define random variables

.

Define random variables

and

and

.

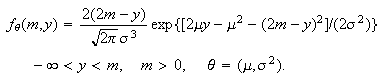

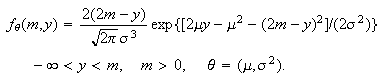

Then the joint probability density function of

.

Then the joint probability density function of

can be shown to be

can be shown to be

It is not hard to show that this is a member of the regular exponential family

of distributions with both parameters assumed unknown. If one parameter is

known, for example,

,

it is again a regular exponential family distribution with

,

it is again a regular exponential family distribution with

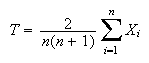

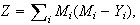

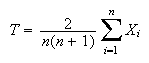

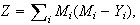

Consequently, if we record independent pairs of observations

Consequently, if we record independent pairs of observations

on the portfolio for a total of

on the portfolio for a total of

distinct time periods (and if we assume no change in the parameters), then the

statistic

distinct time periods (and if we assume no change in the parameters), then the

statistic

is a complete sufficient statistic for the drift parameter

is a complete sufficient statistic for the drift parameter

.

Since it is also an unbiased estimator of

.

Since it is also an unbiased estimator of

it is the U.M.V.U.E. of

it is the U.M.V.U.E. of

.

By Basu's theorem it will be independent of any ancillary statistic, i.e. any

statistic whose distribution does not depend on the parameter

.

By Basu's theorem it will be independent of any ancillary statistic, i.e. any

statistic whose distribution does not depend on the parameter

One such statistic is

One such statistic is

which is therefore independent of

which is therefore independent of

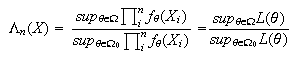

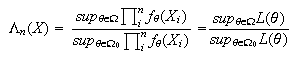

Maximum Likelihood Estimation

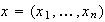

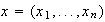

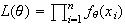

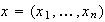

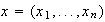

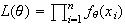

Suppose we have observed

independent discrete random variables all with probability density function

independent discrete random variables all with probability density function

where the scalar parameter

where the scalar parameter

is unknown. Suppose our observations are

is unknown. Suppose our observations are

.

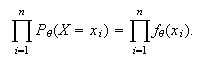

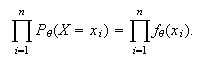

Then the probability of the observed data is:

.

Then the probability of the observed data is:

When the observations have been substituted, this becomes a function of the

parameter only, referred to as the likelihood function and denoted

When the observations have been substituted, this becomes a function of the

parameter only, referred to as the likelihood function and denoted

.

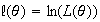

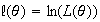

Its natural logarithm is usually denoted

.

Its natural logarithm is usually denoted

.

Now in the absence of any other information, it seems logical that we should

estimate the parameter

.

Now in the absence of any other information, it seems logical that we should

estimate the parameter

using a value most compatible with the data. For example we might choose the

value maximizing the likelihood function

using a value most compatible with the data. For example we might choose the

value maximizing the likelihood function

or equivalently maximizing

or equivalently maximizing

.

We call such a maximizer the maximum likelihood (M.L.) estimate

provided it exists and satisfies any restrictions placed on the parameter. We

denote it by

.

We call such a maximizer the maximum likelihood (M.L.) estimate

provided it exists and satisfies any restrictions placed on the parameter. We

denote it by

.

Obviously, it is a function of the data, that is,

.

Obviously, it is a function of the data, that is,

.

The corresponding estimator is

.

The corresponding estimator is

.

In practice we are usually satisfied with a local maximum of the

likelihood function provided that it is reasonable, partly because the global

maximization problem is often quite difficult, partly because the global

maximum is not always better than a local maximum near a preliminary estimator

that is known to be consistent.. In the case of a twice differentiable log

likelihood function on an open interval, this local maximum is usually found

by solving the equation

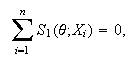

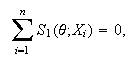

.

In practice we are usually satisfied with a local maximum of the

likelihood function provided that it is reasonable, partly because the global

maximization problem is often quite difficult, partly because the global

maximum is not always better than a local maximum near a preliminary estimator

that is known to be consistent.. In the case of a twice differentiable log

likelihood function on an open interval, this local maximum is usually found

by solving the equation

for a solution

for a solution

,

where

,

where

is called the score function. The equation

is called the score function. The equation

is called the (maximum) likelihood equation or score equation. To

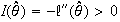

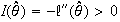

verify a local maximum we compute the second derivative

is called the (maximum) likelihood equation or score equation. To

verify a local maximum we compute the second derivative

and show that it is negative, or alternatively show

and show that it is negative, or alternatively show

.

The function

.

The function

is called the information function. In a sense to be investigated

later,

is called the information function. In a sense to be investigated

later,

,

the observed information, indicates how much information about a

parameter is available in a given experiment. The larger the value, the more

curved is the log likelihood function and the easier it is to find the

maximum.

,

the observed information, indicates how much information about a

parameter is available in a given experiment. The larger the value, the more

curved is the log likelihood function and the easier it is to find the

maximum.

Although we view the likelihood, log likelihood, score and information

functions as functions of

they are, of course, also functions of the observed data

they are, of course, also functions of the observed data

.

When it is important to emphasize the dependence on the data

.

When it is important to emphasize the dependence on the data

we will write

we will write

etc. Also when we wish to determine the sampling properties of these functions

as functions of the random variable

etc. Also when we wish to determine the sampling properties of these functions

as functions of the random variable

we will write

we will write

etc.

etc.

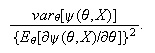

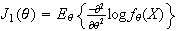

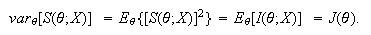

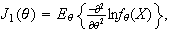

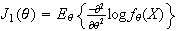

Definition

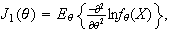

The Fisher or expected information (function) is the expected value

of the information function

.

.

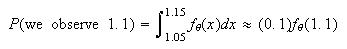

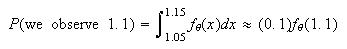

Likelihoods for Continuous Models

Suppose a random variable

has a continuous probability density function

has a continuous probability density function

with parameter

with parameter

.

We will often observe only the value of

.

We will often observe only the value of

rounded to some degree of precision (say 1 decimal place) in which case the

actual observation is a discrete random variable. For example, suppose we

observe

rounded to some degree of precision (say 1 decimal place) in which case the

actual observation is a discrete random variable. For example, suppose we

observe

correct to one decimal place. Then

correct to one decimal place. Then

assuming the function

assuming the function

is quite smooth over the interval. More generally, if we observe

is quite smooth over the interval. More generally, if we observe

rounded to the nearest

rounded to the nearest

(assumed small) then the likelihood of the observation is approximately

(assumed small) then the likelihood of the observation is approximately

.

Since the precision

.

Since the precision

of the observation does not depend on the parameter, then maximizing the

discrete likelihood of the observation is essentially equivalent to maximizing

the the probability density function

of the observation does not depend on the parameter, then maximizing the

discrete likelihood of the observation is essentially equivalent to maximizing

the the probability density function

over the parameter. This partially justifies the use of the probability

density function in the continuous case as the likelihood function.

over the parameter. This partially justifies the use of the probability

density function in the continuous case as the likelihood function.

Similarly, if we observed

independent values

independent values

of a continuous random variable, we would maximize the likelihood

of a continuous random variable, we would maximize the likelihood

(or more commonly its logarithm) to obtain the maximum likelihood estimator of

(or more commonly its logarithm) to obtain the maximum likelihood estimator of

.

.

The relative likelihood function

defined as

defined as

is the ratio of the likelihood to its maximum value and takes on values

between

is the ratio of the likelihood to its maximum value and takes on values

between

and

and

.

It is used to rank possible parameter values according to their plausibility

in light of the data. If

.

It is used to rank possible parameter values according to their plausibility

in light of the data. If

,

say, then

,

say, then

is rather an implausible parameter value because the data are ten times more

likely when

is rather an implausible parameter value because the data are ten times more

likely when

than they are when

than they are when

.

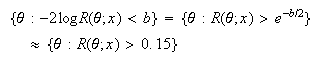

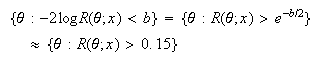

The set of

.

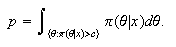

The set of

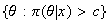

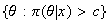

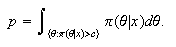

-values

for which

-values

for which

is called a

is called a

likelihood region for

likelihood region for

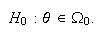

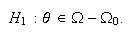

When

the parameter

When

the parameter

is one-dimensional, and

is one-dimensional, and

is its true value,

is its true value,

converges in distribution as the sample size

converges in distribution as the sample size

to a chi-squared distribution with 1 degree of freedom. More generally, the

numbers of degrees of freedom of the limiting chi-squared distribution is the

dimension of the parameter

to a chi-squared distribution with 1 degree of freedom. More generally, the

numbers of degrees of freedom of the limiting chi-squared distribution is the

dimension of the parameter

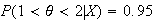

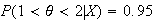

We can use this to construct a confidence interval for the unknown value of

the parameter. For example if

We can use this to construct a confidence interval for the unknown value of

the parameter. For example if

is chosen to be the 0.95 quantile of the chi-squared(1) distribution

(

is chosen to be the 0.95 quantile of the chi-squared(1) distribution

( ,

then

,

then

so a

so a

likelihood interval is an approximate

likelihood interval is an approximate

confidence interval for

confidence interval for

.

This seems to indicate that the confidence interval tolerates a considerable

difference in the likelihood. The likelihood at a parameter value must differ

from the maximum likelihood by a factor of more than

.

This seems to indicate that the confidence interval tolerates a considerable

difference in the likelihood. The likelihood at a parameter value must differ

from the maximum likelihood by a factor of more than

before it is excluded by a

before it is excluded by a

confidence interval or rejected by a test with level of significance 5%.

confidence interval or rejected by a test with level of significance 5%.

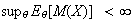

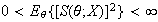

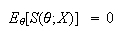

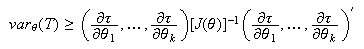

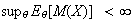

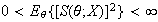

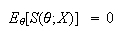

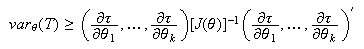

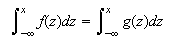

Properties of the Score and Information

Consider a continuous model with a family of probability density functions

.

Suppose all of the densities are supported on a common set

.

Suppose all of the densities are supported on a common set

.

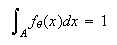

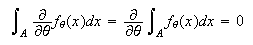

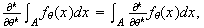

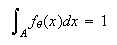

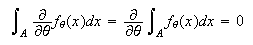

Then

.

Then

and therefore

and therefore

provided that the integral can be interchanged with the derivative. Models

that permit this interchange, and calculation of the Fisher information, are

called regular models.

provided that the integral can be interchanged with the derivative. Models

that permit this interchange, and calculation of the Fisher information, are

called regular models.

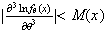

Regular Models

Consider a statistical model

with each density supported by a common set

with each density supported by a common set

.

Suppose

.

Suppose

is an open interval in the real line and

is an open interval in the real line and

for all

for all

and

and

.

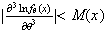

Suppose in addition

.

Suppose in addition

-

![$\ln[f_{\theta}(x)]$](graphics/appendixb__447.png) is a continuous, three times differentiable function of

is a continuous, three times differentiable function of

for all

for all

.

.

-

-

for some function

for some function

satisfying

satisfying

.

.

-

.

.

Then we call this a regular family of distributions or a regular

model. Similarly, if these conditions hold with

a discrete random variable and the integrals replaced by sums, the family is

also called regular. Conditions like these permitting the interchange

of expected values and derivative are sometimes referred to as the Cramer

conditions. In general, they are used to justify passage of a derivative under

an integral.

a discrete random variable and the integrals replaced by sums, the family is

also called regular. Conditions like these permitting the interchange

of expected values and derivative are sometimes referred to as the Cramer

conditions. In general, they are used to justify passage of a derivative under

an integral.

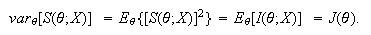

Theorem B8

If

is a random sample from a regular model

is a random sample from a regular model

then

then

and

and

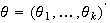

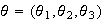

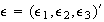

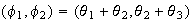

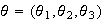

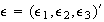

The Multiparameter Case

The case of several parameters is exactly analogous to the scalar parameter

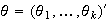

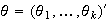

case. Suppose

.

In this case the ``parameter'' can be thought of as a column vector of

.

In this case the ``parameter'' can be thought of as a column vector of

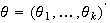

scalar parameters. The score function

scalar parameters. The score function

is a

is a

dimensional

column vector whose

dimensional

column vector whose

component is the derivative of

component is the derivative of

with respect to the

with respect to the

component of

component of

,

that is,

,

that is,

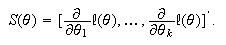

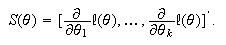

The observed information function

The observed information function

is a

is a

matrix whose

matrix whose

element is

element is

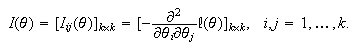

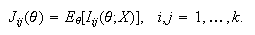

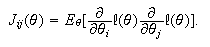

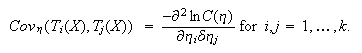

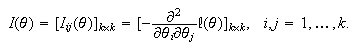

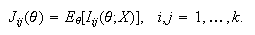

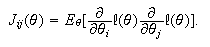

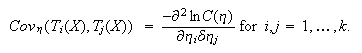

The Fisher information is a

The Fisher information is a

matrix whose components are component-wise expectations of the information

matrix, that is

matrix whose components are component-wise expectations of the information

matrix, that is

The definition of a regular family of distributions is similarly extended. For

a regular family of distributions

The definition of a regular family of distributions is similarly extended. For

a regular family of distributions

and the covariance matrix of the score function

var

and the covariance matrix of the score function

var is the Fisher information, i.e.

is the Fisher information, i.e.

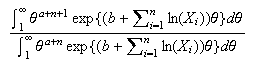

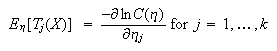

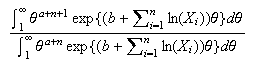

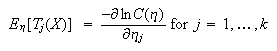

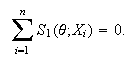

Maximum likelihood Estimation in the Exponential Family

Suppose

has a regular exponential family distribution of the form

has a regular exponential family distribution of the form

Then

Then

and

and

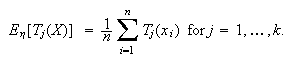

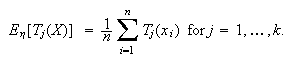

Therefore the maximum likelihood estimator of

Therefore the maximum likelihood estimator of

based on a random sample

based on a random sample

from

from

is the solution to the

is the solution to the

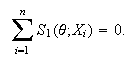

equations

equations

The maximum likelihood estimators are obtained by setting the sample moments

of the natural sufficient statistic equal to their expected values and

solving.

The maximum likelihood estimators are obtained by setting the sample moments

of the natural sufficient statistic equal to their expected values and

solving.

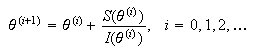

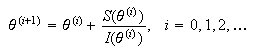

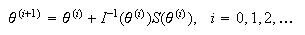

Finding Maximum likelihood estimates using Newton's Method

Suppose that the maximum likelihood estimate

is determined by the likelihood equation

is determined by the likelihood equation

It frequently happens that an analytic solution for

It frequently happens that an analytic solution for

cannot be obtained. If we begin with an approximate value for the parameter,

cannot be obtained. If we begin with an approximate value for the parameter,

,

we may update that value as follows:

,

we may update that value as follows:

and provided that convergence of

and provided that convergence of

obtains, it converges to a solution to the score equation above. In the

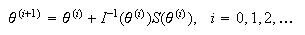

multiparameter case, where

obtains, it converges to a solution to the score equation above. In the

multiparameter case, where

is a vector and

is a vector and

is a matrix, then Newton's method becomes:

is a matrix, then Newton's method becomes:

In both of these, we can replace the information function by the Fisher

information for a similar

algorithm.

In both of these, we can replace the information function by the Fisher

information for a similar

algorithm.

Suppose we consider estimating a parameter

where

where

is a scalar, using an unbiased estimator

is a scalar, using an unbiased estimator

.

Is there any limit to how well an estimator like this can behave? The answer

for unbiased estimators is in the affirmative. A lower bound on the variance

is given by the information inequality.

.

Is there any limit to how well an estimator like this can behave? The answer

for unbiased estimators is in the affirmative. A lower bound on the variance

is given by the information inequality.

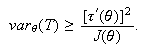

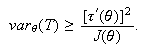

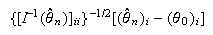

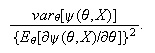

Information Inequality

Suppose

is an unbiased estimator of the parameter

is an unbiased estimator of the parameter

in a regular statistical model

in a regular statistical model

.

Then

.

Then

Equality holds if and only if

Equality holds if and only if

is regular exponential family with natural sufficient statistic

is regular exponential family with natural sufficient statistic

.

.

If equality holds in (CRLB) then we call

an efficient estimator of

an efficient estimator of

.

The number on the right hand side of (CRLB),

.

The number on the right hand side of (CRLB),

-

is called the Cramér-Rao lower bound (C.R.L.B.).

We often express the efficiency of an unbiased

estimator using the ratio of (C.R.L.B.) to the variance of the estimator.

Large values of the efficiciency (i.e. near one) indicate that the variance of

the estimator is close to the lower bound.

The special case of the information inequality that is of most interest is the

unbiased estimation of the parameter

.

The above inequality indicates that any unbiased estimator

.

The above inequality indicates that any unbiased estimator

of

of

has variance at least

has variance at least

.

The lower bound is achieved only when

.

The lower bound is achieved only when

is regular exponential family with natural sufficient statistic

is regular exponential family with natural sufficient statistic

,

so even in the exponential family, only certain parameters are such that we

can find unbiased estimators which achieve the C.R.L.B., namely those that are

expressible as the expected value of the natural sufficient statistics.

,

so even in the exponential family, only certain parameters are such that we

can find unbiased estimators which achieve the C.R.L.B., namely those that are

expressible as the expected value of the natural sufficient statistics.

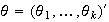

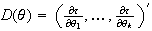

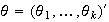

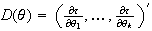

The Multiparameter Case

The right hand side in the information inequality generalizes naturally to the

multiple parameter case in which

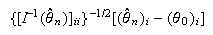

is a vector. For example if

is a vector. For example if

,

then the Fisher information

,

then the Fisher information

is a

is a

matrix. If

matrix. If

is any real-valued function of

is any real-valued function of

then its derivative is a column

vector

then its derivative is a column

vector .

Then if

.

Then if

is any unbiased estimator of

is any unbiased estimator of

in a regular model,

in a regular model,

for all

for all

.

.

Asymptotic Properties of maximum likelihood Estimators

One of the more successful attempts at justifying estimators and demonstrating

some form of optimality has been through large sample theory or the

asymptotic behaviour of estimators as the sample size

.

One of the first properties one requires is consistency of an estimator. This

means that the estimator converges to the true value of the parameter as the

sample size (and hence the information) approaches infinity.

.

One of the first properties one requires is consistency of an estimator. This

means that the estimator converges to the true value of the parameter as the

sample size (and hence the information) approaches infinity.

Definition

Consider a sequence of estimators

where the subscript

where the subscript

indicates that the estimator has been obtained from data

indicates that the estimator has been obtained from data

with sample size

with sample size

.

Then the sequence is said to be a consistent sequence of estimators

of

.

Then the sequence is said to be a consistent sequence of estimators

of

if

if

for all

for all

.

.

It is worth a reminder at this point that probability density functions are

used to produce probabilities and are only unique up to a point. For example

if two probability density functions

and

and

were such that they produced the same probabilities, or the same cumulative

distribution function, for example,

were such that they produced the same probabilities, or the same cumulative

distribution function, for example,

for all

for all

then we would not consider them distinct probability densities, even though

then we would not consider them distinct probability densities, even though

and

and

may differ at one or more values of

may differ at one or more values of

.

Now when we parameterize a given statistical model using

.

Now when we parameterize a given statistical model using

as the parameter, it is natural to do so in such a way that different

values of the parameter lead to distinct probability density functions.

This means, for example, that the cumulative distribution functions associated

with these densities are distinct. Without this assumption, made in the

following theorem, it would be impossible to accurately estimate the parameter

since two different parameters could lead to the same cumulative distribution

function and hence exactly the same behaviour of the observations.

as the parameter, it is natural to do so in such a way that different

values of the parameter lead to distinct probability density functions.

This means, for example, that the cumulative distribution functions associated

with these densities are distinct. Without this assumption, made in the

following theorem, it would be impossible to accurately estimate the parameter

since two different parameters could lead to the same cumulative distribution

function and hence exactly the same behaviour of the observations.

Theorem B9

Suppose

is a random sample from a regular statistical model

{

is a random sample from a regular statistical model

{ .

Assume the densities corresponding to different values of the parameters are

distinct. Let

.

Assume the densities corresponding to different values of the parameters are

distinct. Let

.

Then with probability tending to

.

Then with probability tending to

as

as

,

the likelihood equation

,

the likelihood equation

has a root

has a root

such that

such that

converges in probability to

converges in probability to

,

the true value of the parameter, as

,

the true value of the parameter, as

.

.

The likelihood equation above does not always have a unique root. The

consistency of the maximum likelihood estimator is one indication that it

performs reasonably well. However, it provides no reason to prefer it to some

other consistent estimator. The following result indicates that maximum

likelihood estimators perform as well as any reasonable estimator can, at

least in the limit as

.

Most of the proofs of these asymptotic results can be found in Lehmann(1991).

.

Most of the proofs of these asymptotic results can be found in Lehmann(1991).

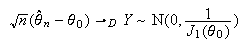

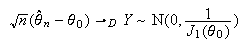

Theorem B10

Suppose

is a random sample from a regular statistical model

is a random sample from a regular statistical model

.

Suppose

.

Suppose

is a consistent root of the likelihood equation as in the theorem above. Let

is a consistent root of the likelihood equation as in the theorem above. Let

the Fisher information for a sample of size one. Then

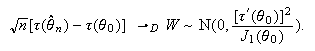

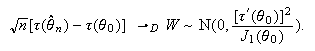

the Fisher information for a sample of size one. Then

where

where

is the true value of the parameter.

is the true value of the parameter.

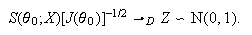

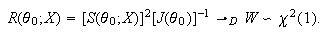

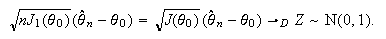

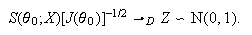

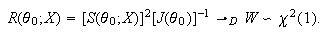

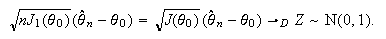

This result may also be written as

This theorem asserts that, at least under the regularity required, the maximum

likelihood estimator is asymptotically unbiased. Moreover, the asymptotic

variance of the maximum likelihood estimator approaches the Cramér-Rao

lower bound for unbiased estimators. This justifies the comparison of the

variance of an estimator

based on a sample of size

based on a sample of size

to the value

to the value

,

which is the asymptotic variance of the maximum likelihood estimator

and also the Cramér-Rao lower bound.

,

which is the asymptotic variance of the maximum likelihood estimator

and also the Cramér-Rao lower bound.

It also follows that

This indicates that the asymptotic variance of any function

This indicates that the asymptotic variance of any function

of the maximum likelihood estimator also achieves the Cramér-Rao lower

bound.

of the maximum likelihood estimator also achieves the Cramér-Rao lower

bound.

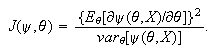

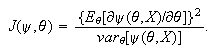

Definition

Suppose

is asymptotically normal with mean

is asymptotically normal with mean

and variance

and variance

.

The asymptotic efficiency of

.

The asymptotic efficiency of

is defined to be

is defined to be

.

This is the ratio of the Cramér-Rao lower bound to the variance of

.

This is the ratio of the Cramér-Rao lower bound to the variance of

and is typically less than one, close to one indicating the asymptotic

efficiency is close to that of the maximum likelihood estimator.

and is typically less than one, close to one indicating the asymptotic

efficiency is close to that of the maximum likelihood estimator.

The Multiparameter Case

In the case

,

the score function is the vector of partial derivatives of the log likelihood

with respect to the components of

,

the score function is the vector of partial derivatives of the log likelihood

with respect to the components of

.

Therefore the likelihood equation is

.

Therefore the likelihood equation is

equations in the

equations in the

unknown parameters. Under similar regularity conditions to the univariate

case, the conclusion of Theorem B9 holds in this case, that is, the components

of

unknown parameters. Under similar regularity conditions to the univariate

case, the conclusion of Theorem B9 holds in this case, that is, the components

of

each converge in probability to the corresponding component of

each converge in probability to the corresponding component of

.

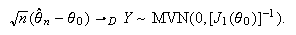

Similarly, the asymptotic normality remains valid in this case with little

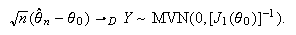

modification. Let

.

Similarly, the asymptotic normality remains valid in this case with little

modification. Let

be the Fisher information matrix for a sample of size one and assume it is a

non-singular matrix. Then

be the Fisher information matrix for a sample of size one and assume it is a

non-singular matrix. Then

where

the multivariate normal distribution with

where

the multivariate normal distribution with

-dimensional

mean vector

-dimensional

mean vector

and covariance matrix

and covariance matrix

(

( )

, denoted

)

, denoted

has probability density function defined on

has probability density function defined on

,

,

It also follows that

where

where

.

Once again the asymptotic variance-covariance matrix is identical to the lower

bound given by the multiparameter case of the Information Inequality.

.

Once again the asymptotic variance-covariance matrix is identical to the lower

bound given by the multiparameter case of the Information Inequality.

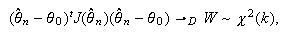

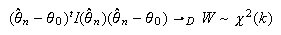

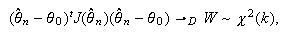

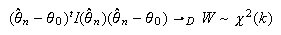

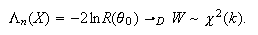

Joint confidence regions can be constructed based on one of the asymptotic

results

or

or

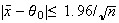

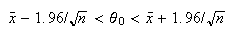

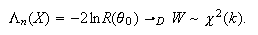

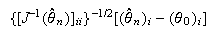

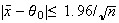

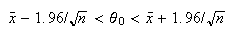

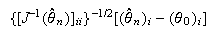

Confidence intervals for a single parameter, say

Confidence intervals for a single parameter, say

,

can be based on the approximate normality of

,

can be based on the approximate normality of

or

or

where

where

is the

is the

entry in the vector

entry in the vector

and

and

![$[A^{-1}]_{ii}$](graphics/appendixb__603.png) is the

is the

entry in the matrix

entry in the matrix

.

.

Unidentifiability and Singular Information Matrices

Suppose we observe two independent random variables

having normal distributions with the same variance

having normal distributions with the same variance

and means

and means

respectively. In this case, although the means depend on the parameter

respectively. In this case, although the means depend on the parameter

,

the value of this vector parameter is unidentifiable in the sense

that, for some pairs of distinct parameter values, the probability density

function of the observations are identical. For example the parameter

,

the value of this vector parameter is unidentifiable in the sense

that, for some pairs of distinct parameter values, the probability density

function of the observations are identical. For example the parameter

leads to exactly the same joint distribution of

leads to exactly the same joint distribution of

as does the parameter

as does the parameter

.

In this case, we we might consider only the two parameters

.

In this case, we we might consider only the two parameters

and anything derivable from this pair estimable, while parameters such as

and anything derivable from this pair estimable, while parameters such as

that cannot be obtained as functions of

that cannot be obtained as functions of

are consequently unidentifiable. The solution to the original identifiability

problem is the reparametrization to the new parameter

are consequently unidentifiable. The solution to the original identifiability

problem is the reparametrization to the new parameter

in this case, and in general, unidentifiability usually means one should seek

a new, more parsimonious parametrization.

in this case, and in general, unidentifiability usually means one should seek

a new, more parsimonious parametrization.

In the above example, compute the Fisher information matrix for the parameter

.

Notice that the Fisher information matrix is singular. This means that if you

were to attempt to compute the asymptotic variance of the maximum likelihood

estimator of

.

Notice that the Fisher information matrix is singular. This means that if you

were to attempt to compute the asymptotic variance of the maximum likelihood

estimator of

by inverting the Fisher information matrix, the inversion would be impossible.

Attempting to invert a singular matrix is like attempting to invert the number

0. It results in one or more components that you can consider to be infinite.

Arguing intuitively, the asymptotic variance of the maximum likelihood

estimator of some of the parameters is infinite. This is an indication that

asymptotically, at least, some of the parameters may not be identifiable. When

parameters are unidentifiable, the Fisher information matrix is generally

singular. However, when

by inverting the Fisher information matrix, the inversion would be impossible.

Attempting to invert a singular matrix is like attempting to invert the number

0. It results in one or more components that you can consider to be infinite.

Arguing intuitively, the asymptotic variance of the maximum likelihood

estimator of some of the parameters is infinite. This is an indication that

asymptotically, at least, some of the parameters may not be identifiable. When

parameters are unidentifiable, the Fisher information matrix is generally

singular. However, when

is singular for all values of

is singular for all values of

,

this may or may not mean parameters are unidentifiable for finite sample

sizes, but it does usually mean one should take a careful look at the

parameters with a possible view to adopting another parametrization.

,

this may or may not mean parameters are unidentifiable for finite sample

sizes, but it does usually mean one should take a careful look at the

parameters with a possible view to adopting another parametrization.

U.M.V.U.E.'s and maximum likelihood

Estimators: A Comparison

Which of the two main types of estimators should we use? There is no general

consensus among statisticians.

-

If we are estimating the expectation of a natural sufficient statistic

in a regular exponential family both maximum likelihood and unbiasedness

considerations lead to the use of

in a regular exponential family both maximum likelihood and unbiasedness

considerations lead to the use of

as an estimator.

as an estimator.

-

When sample sizes are large U.M.V.U.E's and maximum likelihood estimators are

essentially the same. In that case use is governed by ease of computation.

Unfortunately how large ``large'' needs to be is usually unknown. Some studies

have been carried out comparing the behaviour of U.M.V.U.E.'s and maximum

likelihood estimators for various small fixed sample sizes. The results are,

as might be expected, inconclusive.

-

maximum likelihood estimators exist ``more frequently'' and when they do they

are usually easier to compute than U.M.V.U.E.'s. This is essentially because

of the appealing invariance property of maximum likelihood estimators.

-

Simple examples are known for which maximum likelihood estimators behave badly

even for large samples. This is more often the case when there is a large

number of parameters, some of which, termed ``nuisance parameters'' are of no

direct interest, but complicate the estimation.

-

U.M.V.U.E.'s and maximum likelihood estimators are not necessarily robust. A

small change in the underlying distribution or the data could result in a

large change in the estimator.

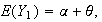

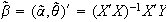

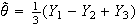

Other Estimation Criteria

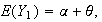

Best Linear Unbiased Estimators

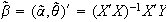

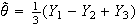

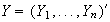

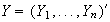

The problem of finding best unbiased estimators is considerably simpler if we

limit the class in which we search. If we permit any function of the data,

then we usually require the heavy machinery of complete sufficiency to produce

U.M.V.U.E.'s. However, the situation is much simpler if we suggest some

initial random variables and then require that our estimator be a linear

combination of these. Suppose, for example we have random variables

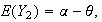

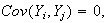

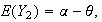

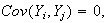

with

with

where

where

is the parameter of interest and

is the parameter of interest and

is another parameter. What linear combinations of the

is another parameter. What linear combinations of the

's

provide an unbiased estimator of

's

provide an unbiased estimator of

and among these possible linear combinations which one has the smallest

possible variance? To answer these questions, we need to know the covariances

and among these possible linear combinations which one has the smallest

possible variance? To answer these questions, we need to know the covariances

(at least up to some scalar multiple). Suppose

(at least up to some scalar multiple). Suppose

and

var

and

var .

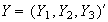

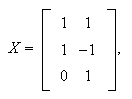

Let

.

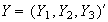

Let

and

and

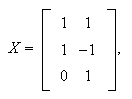

We can write the model in a form reminiscent of linear regression as

We can write the model in a form reminiscent of linear regression as

where

where

and the

and the

's

are uncorrelated random variables with

's

are uncorrelated random variables with

and

var

and

var .

Then the linear combination of the components of

.

Then the linear combination of the components of

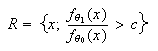

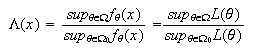

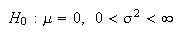

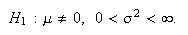

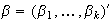

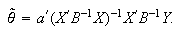

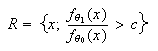

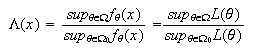

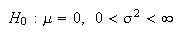

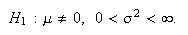

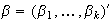

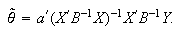

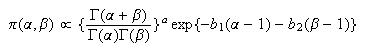

that has the smallest variance among all unbiased estimators of